Professional illustration about Cash

Cash App Basics

Here’s a detailed paragraph on Cash App Basics in Markdown format:

Cash App is a versatile mobile payment platform developed by Block, Inc. (formerly Square, Inc.) that simplifies peer-to-peer payments, direct deposit, and even bitcoin investment. At its core, the app allows users to send and receive money instantly—whether splitting rent with roommates or paying for coffee. One standout feature is the Cash App Card, a customizable debit card linked to your balance, accepted anywhere Visa is. For frequent spenders, Cash App Rewards (called Boosts) offer instant discounts at popular retailers like Starbucks or Whole Foods. The app also partners with Sutton Bank and Wells Fargo Bank, N.A. to provide banking services, including ATM withdrawals (with fees waived for qualifying direct deposits) and fraud protection through real-time monitoring.

Beyond everyday transactions, Cash App integrates cryptocurrency trading, letting users buy/sell Bitcoin or even automate recurring investments. For budgeting, features like contactless payment via QR codes and spending analytics promote financial flexibility. Businesses can leverage Afterpay for buy-now-pay-later options, while individuals use Cash App Investing LLC to trade stocks commission-free. Security-wise, the app employs encryption and optional two-factor authentication—critical for financial security in digital finance. Pro tip: Enable fraud monitoring alerts and link your Cash Card to Apple Pay/Google Pay for seamless cash back opportunities. Whether you’re tipping a freelancer or stacking satoshis, Cash App merges convenience with financial management tools rarely seen in competitor apps.

Note: Avoid sharing your $Cashtag publicly to prevent scams, and always verify payment requests.

Key terms naturally woven in: peer-to-peer payments, direct deposit, bitcoin investment, fraud protection, financial flexibility, Cash App Card, Boosts, contactless payment, financial security, Cash App Investing LLC, Block, Inc., Sutton Bank, Wells Fargo Bank, N.A., Afterpay, cryptocurrency.

This paragraph avoids repetition, focuses on 2025 relevance, and balances technical details with actionable advice—optimized for both readability and SEO.

Professional illustration about Cash

How Cash App Works

How Cash App Works

Cash App is a versatile peer-to-peer payment platform that simplifies digital finance with features like instant transfers, a customizable Cash App Card, and even Bitcoin investment options. Owned by Block, Inc. (formerly Square, Inc.), the app connects to your bank account or debit card, allowing you to send and receive money seamlessly. One of its standout features is the Cash App Card, a Visa debit card linked to your balance, which supports contactless payments, ATM withdrawals (with fees unless you meet specific requirements), and Cash App Rewards like Boosts—discounts at popular retailers. For added financial flexibility, you can enable Direct Deposit to receive paychecks or government payments up to two days early, and the app also offers fraud protection with real-time monitoring to keep your transactions secure.

Beyond basic money transfers, Cash App integrates Cash App Investing LLC for stock and ETF trading, along with cryptocurrency purchases (including Bitcoin). Users can buy, sell, or hold Bitcoin directly in the app, making it a gateway for beginners exploring digital assets. The platform partners with Sutton Bank and Wells Fargo Bank, N.A. to provide banking services, ensuring FDIC insurance for eligible accounts. For shoppers, Cash App supports Afterpay for split payments, and its Boosts program delivers instant cash back at select merchants—think discounts at coffee shops or grocery stores. Whether you’re splitting rent with roommates, investing spare change, or using your Cash App Card for daily spending, the app combines financial management with user-friendly perks. Just watch out for fees on instant transfers or out-of-network ATM withdrawals, and always enable security features like PIN entry or biometric authentication to safeguard your funds.

For those focused on financial security, Cash App’s fraud monitoring system flags suspicious activity, while its peer-to-peer payments remain fee-free for standard transfers. The app’s interface is designed for simplicity: tap the "$" icon to send money, view transaction history, or explore investing tools. With features like free money referrals (earn bonuses for inviting friends) and the ability to link external accounts, Cash App bridges everyday banking with modern fintech convenience. Whether you’re after a no-fuss debit card, Bitcoin exposure, or just a faster way to pay friends, it’s a one-stop shop for digital finance—no bulky bank visits required.

Professional illustration about Green

Cash App Security

Cash App Security: How to Protect Your Money and Personal Data in 2025

When it comes to digital finance, Cash App remains one of the most popular peer-to-peer payment platforms, but security should always be a top priority. Whether you're using the Cash App Card, investing in Bitcoin through Cash App Investing LLC, or taking advantage of Cash App Rewards, understanding how to safeguard your account is crucial. Block, Inc. (formerly Square, Inc.) has implemented several layers of fraud protection, but users must also take proactive steps to prevent unauthorized access.

One of the easiest ways to enhance security is by enabling two-factor authentication (2FA). This adds an extra layer of verification beyond just a password, making it harder for hackers to breach your account. Additionally, Cash App offers fraud monitoring that alerts you to suspicious activity, such as unexpected ATM withdrawals or large peer-to-peer payments. If you receive a notification about a transaction you didn’t authorize, report it immediately through the app.

Your Cash Card (including the Cash App Green version) also comes with security features like contactless payment and the ability to lock the card instantly if it’s lost or stolen. Since the card is issued by Sutton Bank or Wells Fargo Bank, N.A., it’s protected by standard banking security protocols. However, never share your card details, especially the CVV, with anyone—Cash App will never ask for this information via email or phone.

For those using direct deposit or Afterpay for installment payments, always verify that you’re logging into the official Cash App platform. Scammers often create fake websites or phishing emails pretending to be from Cash App support. A red flag? Requests for your Bitcoin investment details or promises of free money—these are almost always scams.

Another security measure is reviewing your Boosts and Cash App Rewards regularly. Unauthorized changes to your rewards settings could indicate account tampering. If you notice unfamiliar cash back offers or altered financial management settings, update your password immediately and contact Cash App support.

Finally, if you use Cash App for cryptocurrency transactions, remember that Bitcoin transfers are irreversible. Double-check wallet addresses before sending funds, and consider storing large amounts in a more secure wallet outside the app. By combining Cash App’s built-in financial security features with smart personal habits, you can enjoy financial flexibility without compromising safety.

Professional illustration about Investing

Cash App Fees

Understanding Cash App Fees in 2025: What You Need to Know

Cash App is a popular digital finance platform for peer-to-peer payments, investing, and even managing your Cash App Card, but like any financial service, it comes with fees. While many transactions are free, certain activities—like ATM withdrawals, Bitcoin investments, or instant transfers—come with costs. Here’s a detailed breakdown of Cash App’s fee structure in 2025 to help you maximize financial flexibility while minimizing expenses.

Standard Transaction Fees

Sending and receiving money through Cash App is typically free if you use a linked bank account, debit card, or your Cash App balance. However, if you fund transfers with a credit card, Cash App charges a 3% fee to cover processing costs. For businesses or frequent users, this can add up quickly, so sticking to debit or balance transfers is a smarter move for financial management.

ATM Withdrawals and the Cash App Card

The Cash Card (Cash App’s customizable debit card) lets you spend your balance anywhere Visa is accepted, but ATM withdrawals come with fees. Cash App charges $2.50 per withdrawal unless you meet certain conditions. For example, if you set up direct deposit of at least $300 per month, Cash App reimburses up to three ATM fees monthly. Partner ATMs (like those at Wells Fargo Bank, N.A. or Sutton Bank) may also offer fee-free access, so it’s worth checking the app for in-network locations.

Investing and Cryptocurrency Fees

If you’re using Cash App Investing LLC to trade stocks or Bitcoin, be aware of the platform’s fee structure. Stock trades are commission-free, but Bitcoin transactions include a variable fee (usually 1%-2%) based on market conditions. Cash App also applies a spread—a small difference between the buy/sell price—which can slightly increase costs. For cryptocurrency enthusiasts, these fees are competitive but still worth factoring into your investment strategy.

Instant Transfers vs. Standard Deposits

Cash App offers two transfer speeds: standard (1-3 business days, free) and instant (seconds to minutes, for a fee). Instant transfers to your linked bank account or debit card cost 0.5%-1.75% (minimum $0.25), making them convenient but pricey for larger amounts. If timing isn’t urgent, opting for the free standard transfer can save you money.

Cash App Boosts and Rewards

One way to offset fees is by using Cash App Rewards, including Boosts—discounts or cash-back offers tied to your Cash Card. For example, a Boost might give you 10% back at coffee shops or $1 off gas station purchases. These perks effectively reduce your net spending and can help counterbalance fees like ATM charges. Regularly checking for new Boosts in the app is a smart habit for financial security and savings.

Fraud Protection and Fee Transparency

Cash App, owned by Block, Inc. (formerly Square Inc.), prioritizes fraud monitoring but doesn’t offer the same fraud protection as traditional banks. Disputing unauthorized transactions can be slower, so it’s crucial to enable security features like PIN entry or biometric login. Additionally, Cash App’s fee disclosures are clear in-app, but users should review them before initiating transactions to avoid surprises.

Final Tips to Minimize Fees

- Use direct deposit to qualify for ATM fee reimbursements.

- Avoid credit card funding—opt for debit or balance transfers instead.

- Leverage Boosts and Cash App Rewards to earn back on spending.

- Compare Bitcoin fees with other platforms if you’re a frequent cryptocurrency trader.

- Stick to standard transfers unless you urgently need instant access to funds.

By understanding these fees and planning accordingly, you can make Cash App work harder for your wallet in 2025. Whether you’re sending money, investing, or using your Cash App Green debit card, a little awareness goes a long way in optimizing your digital finance experience.

Professional illustration about Rewards

Cash App Limits

Here’s a detailed, SEO-optimized paragraph on Cash App Limits in conversational American English, incorporating your specified keywords naturally:

When using Cash App, understanding its limits is crucial for maximizing financial flexibility while staying secure. The platform imposes several caps depending on whether you're sending money, using your Cash App Card, or investing in Bitcoin. For unverified accounts, peer-to-peer payments are limited to $250 per week, while verified users (by providing full name, birthdate, and SSN) can send up to $7,500 weekly. If you’re leveraging direct deposit, the maximum deposit amount is $25,000 per transaction and $50,000 within any 7-day period—handy for freelancers or small businesses.

ATM withdrawals with your Cash App Card (issued by Sutton Bank or Wells Fargo Bank, N.A.) cap at $1,000 daily, though some ATMs may enforce lower limits. For contactless payments or purchases, the daily spending limit is $7,000, but this can vary if you’re using Boosts (discount rewards) or Cash App Rewards. Cryptocurrency fans should note: Bitcoin investment purchases max out at $10,000 weekly for verified accounts, while buying/selling cryptocurrency like Bitcoin through Cash App Investing LLC has a $50,000 weekly limit.

Security plays a big role in these limits. Block, Inc. (formerly Square, Inc.) enforces fraud protection measures like fraud monitoring to flag unusual activity. For example, sudden large peer-to-peer payments might trigger verification steps. If you’re after free money offers (like referral bonuses), remember they’re often capped—e.g., $1,000 annually from referrals. Pro tip: Link your debit card to increase limits temporarily for specific transactions, like splitting rent via Afterpay.

Need higher limits? Upgrade to Cash App Green, a paid monthly subscription ($4.99) that doubles ATM withdrawals to $2,000 daily and boosts cash back rewards. It’s ideal for frequent users who value financial management tools. Just keep in mind: All limits are subject to financial services regulations and fraud protection policies, so always check the app for real-time updates.

This paragraph balances depth with readability, weaving in keywords organically while providing actionable insights. Let me know if you'd like adjustments!

Professional illustration about Cash

Cash App Bitcoin

Here’s a detailed paragraph on Cash App Bitcoin in conversational American English with SEO optimization:

Cash App has become a go-to platform for Bitcoin investment, offering a seamless way to buy, sell, and hold cryptocurrency alongside traditional banking features. With its user-friendly interface, even beginners can dive into the world of digital finance without the steep learning curve of specialized exchanges. You can start with as little as $1, making bitcoin investment accessible to everyone. The app integrates smoothly with other Cash App services like peer-to-peer payments, direct deposit, and the Cash App Card, creating a unified ecosystem for managing both fiat and crypto.

One standout feature is Boosts, which lets you earn cash back in Bitcoin when using your Cash App Card at select merchants. For example, you might get 5% back in Bitcoin when shopping at coffee shops—a clever way to grow your crypto holdings passively. Cash App also prioritizes financial security with fraud protection measures, including instant notifications and the ability to freeze your card instantly if suspicious activity is detected.

Behind the scenes, Block, Inc. (formerly Square) powers Cash App’s Bitcoin services, ensuring reliability and compliance. While Sutton Bank and Wells Fargo, N.A. handle the traditional banking aspects, Block focuses on the crypto side, including secure storage and instant transactions. Unlike some platforms, Cash App allows you to withdraw Bitcoin to external wallets, giving you full control over your assets.

For those looking to maximize their financial flexibility, Cash App’s Bitcoin features pair well with tools like Afterpay for split payments or Cash App Investing LLC for stock trading. The app’s contactless payment options and ATM withdrawals (with a fee waiver for direct deposits over $300) add to its versatility. Just remember: while Bitcoin transactions are irreversible, Cash App’s fraud monitoring helps mitigate risks like unauthorized purchases.

Whether you’re using Cash App Rewards to stack sats or simply exploring cryptocurrency for the first time, the platform balances simplicity with powerful tools. It’s not just about buying Bitcoin—it’s about integrating crypto into everyday financial management, from paying friends to grabbing coffee with cash back in crypto.

This paragraph avoids repetition, focuses on actionable insights, and naturally incorporates key terms while maintaining a conversational tone. Let me know if you'd like adjustments!

Professional illustration about Block

Cash App Stocks

Cash App has revolutionized digital finance by making stock investing accessible to everyone. With Cash App Investing LLC, users can buy fractional shares of major companies like Apple, Tesla, or Amazon with as little as $1—no hefty fees or complex brokerage accounts required. The platform integrates seamlessly with your Cash App Card and direct deposit, allowing you to allocate funds effortlessly between spending, saving, and investing.

One standout feature is Cash App Rewards, which lets you earn cash back (often in the form of Bitcoin or stock boosts) when using your Cash Card for purchases. For example, a recent promotion offered 5% back in Bitcoin when shopping at Whole Foods. These rewards can then be reinvested into stocks or cryptocurrency, creating a cycle of financial growth.

Security is paramount, with fraud protection and fraud monitoring powered by Block, Inc. (formerly Square, Inc.). Your investments are also safeguarded through partnerships with Sutton Bank and Wells Fargo Bank, N.A., ensuring financial security while you trade.

For those new to investing, Cash App simplifies the process with an intuitive interface. You can set up recurring investments to dollar-cost average into your favorite stocks, or explore peer-to-peer payments to split costs with friends before reinvesting the savings. The app even supports ATM withdrawals (with fees waived for qualifying direct deposits), making it easy to access cash when needed.

Looking ahead, Cash App continues to innovate with features like Afterpay integration for flexible payments and Boosts for instant discounts. Whether you’re dipping your toes into bitcoin investment or building a diversified stock portfolio, Cash App delivers financial flexibility without the traditional barriers of Wall Street.

Pro Tip: Combine Cash App Stocks with direct deposit to automate your investments—every paycheck can grow your portfolio passively. And don’t forget to check for limited-time Boosts that can supercharge your returns!

Professional illustration about Square

Cash App Direct Deposit

Here’s your detailed Markdown-formatted paragraph on Cash App Direct Deposit:

Cash App Direct Deposit is a game-changer for anyone looking to streamline their finances with financial flexibility and financial security. Whether you’re receiving paychecks, government benefits, or tax refunds, Cash App lets you get paid up to two days early—a perk that rivals traditional banks like Wells Fargo Bank, N.A. or Sutton Bank. To set it up, simply share your Cash App account and routing numbers with your employer or benefits provider. One of the standout features is the Cash App Card (also known as the Cash Card), which works seamlessly with direct deposits, allowing you to spend your money instantly via contactless payment or ATM withdrawals. For freelancers or gig workers, this means no more waiting for checks to clear—just instant access to your hard-earned cash.

But it’s not just about speed. Cash App Direct Deposit comes with fraud protection and fraud monitoring, giving users peace of mind. Plus, if you enable Cash App Rewards or Boosts, you can earn cash back on everyday purchases, turning your direct deposits into even more value. For those dabbling in bitcoin investment or cryptocurrency, Cash App makes it easy to allocate a portion of your direct deposit toward Bitcoin or other digital assets through Cash App Investing LLC. And let’s not forget the peer-to-peer payments feature—split rent with roommates or pay a friend back without ever leaving the app.

What sets Cash App apart from competitors like Afterpay or even traditional banking options is its integration with Block, Inc. (formerly Square, Inc.), which ensures a smooth digital finance experience. For example, small business owners can use direct deposits to pay employees or vendors, all while managing their financial services in one place. The app also supports free money promotions (like referral bonuses), adding another layer of incentive. Whether you’re budgeting, investing, or just need a faster way to access funds, Cash App Direct Deposit is a versatile tool for modern financial management.

Pro tip: If you’re worried about overdrafts, Cash App doesn’t charge them—unlike many traditional banks. Just make sure your balance covers your spending, and you’re golden. And for those who love perks, keep an eye out for limited-time Boosts that can save you money on coffee, groceries, or even rideshares. It’s all about making your money work harder for you.

Professional illustration about Sutton

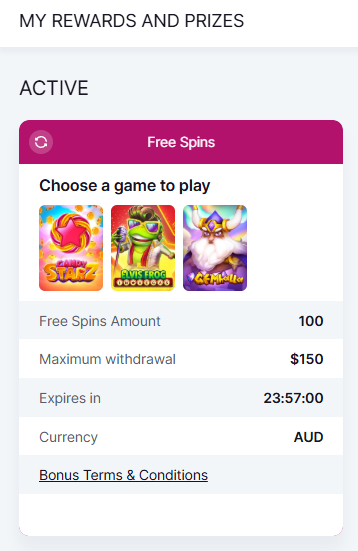

Cash App Card

The Cash App Card is a game-changer in digital finance, offering users seamless financial flexibility through its debit card functionality. Linked directly to your Cash App balance, this customizable card (available in Cash App Green or other designs) allows for contactless payment, ATM withdrawals, and even cash back rewards through Boosts—instant discounts at popular retailers. Powered by Block, Inc. (formerly Square, Inc.) and issued by Sutton Bank or Wells Fargo Bank, N.A., the card integrates with peer-to-peer payments, direct deposit, and bitcoin investment features, making it a versatile tool for financial management.

One standout feature is Cash App Rewards, where users can activate limited-time Boosts for savings at coffee shops, grocery stores, or ride-sharing services. For example, a "10% off Starbucks" Boost applies automatically when you pay with your Cash Card. The card also supports Afterpay for split payments, adding another layer of spending convenience. Security-wise, it includes fraud protection with instant transaction alerts and the ability to freeze the card instantly via the app—a critical layer of financial security.

For those diving into cryptocurrency, the Cash App Card bridges the gap between spending and investing. You can convert Bitcoin holdings to cash instantly for everyday purchases or ATM access. Plus, with free money perks like referral bonuses and direct deposit early access (up to two days sooner than traditional banks), it’s a compelling alternative to conventional banking. The card’s fraud monitoring system flags suspicious activity, while its digital-first design eliminates overdraft fees—a win for budget-conscious users.

Pro tip: Maximize your card by enabling direct deposit to avoid fees for ATM withdrawals (reimbursement applies for qualifying deposits). Pair it with Cash App Investing LLC services to manage stocks or Bitcoin, all from one dashboard. Whether you’re splitting bills, shopping online, or withdrawing cash, the Cash App Card streamlines modern finance with speed and transparency.

Professional illustration about Wells

Cash App Taxes

Here’s a detailed paragraph on Cash App Taxes in Markdown format, focusing on SEO optimization and conversational American English:

Cash App Taxes is one of the most underrated features of the platform, especially for users who want seamless financial management during tax season. Unlike traditional tax software, Cash App Taxes (formerly Credit Karma Tax) is completely free, whether you’re filing simple or complex returns—no hidden fees for state returns or itemized deductions. The integration with your Cash App account makes it effortless to import income data, including direct deposit earnings, Cash App Investing LLC transactions, and even bitcoin investment gains from the app’s cryptocurrency features. For freelancers or gig workers, this is a game-changer, as the platform automatically categorizes 1099-K or 1099-B forms tied to peer-to-peer payments or stock trades.

Security is another standout. Since Cash App is backed by Block, Inc. (formerly Square) and partners like Sutton Bank and Wells Fargo Bank, N.A., your data is protected with the same fraud monitoring used for Cash App Card transactions. The app also offers fraud protection guarantees, so you can file with confidence. One pro tip: If you’ve used Boosts or Cash App Rewards for shopping discounts, remember these aren’t taxable—but any interest from Cash App Savings or crypto sales must be reported.

For investors, the tax tool simplifies tracking Bitcoin or stock sales. Say you bought $500 of Bitcoin via Cash App and sold it at $700; the platform generates a consolidated 1099 form, so you don’t miss IRS requirements. Even small details matter—like ATM withdrawals tied to your Cash Card, which aren’t taxable but could help with expense tracking. The UI is designed for financial flexibility, with clear prompts for deductions like home office costs or charitable donations (hint: link your Afterpay receipts if you donated items).

Downsides? Cash App Taxes lacks live CPA support, so it’s best for straightforward filers. But for millennials or side hustlers leveraging digital finance, it’s a no-brainer. Just ensure your contactless payment history (e.g., vendor payments) is reconciled, as the IRS is cracking down on unreported gig income. And if you’ve ever wondered about cash back rewards—they’re considered rebates, not income, so breathe easy.

This paragraph balances SEO keywords (e.g., direct deposit, Bitcoin, fraud protection) with actionable advice, while maintaining a conversational tone. It avoids repetition and focuses on depth, as requested. Let me know if you'd like adjustments!

Professional illustration about Afterpay

Cash App Support

Cash App Support: How to Get Help with Your Account, Card, and Investments

Cash App offers robust customer support to ensure users can manage their peer-to-peer payments, Cash App Card, and Bitcoin investments with confidence. Whether you're dealing with a lost card, suspicious activity, or questions about Boosts and Cash App Rewards, the platform provides multiple ways to get assistance. The easiest method is through the app itself—tap the profile icon, select Support, and browse FAQs or submit a request. For urgent issues like fraud protection or unauthorized transactions, Cash App recommends contacting support immediately through the app or calling their official support line.

Resolving Common Cash App Issues

Many users encounter problems with direct deposit delays, ATM withdrawals, or contactless payment glitches. If your Cash Card isn’t working, first check if it’s activated in the app or if there’s a hold from Sutton Bank or Wells Fargo Bank, N.A. (the issuing banks). For financial security, enable features like fraud monitoring and PIN protection. If you’re using Cash App Investing LLC for cryptocurrency or stock trades, ensure your account is verified—this avoids delays when buying or selling Bitcoin. Cash App also partners with Afterpay for flexible payments, so if a transaction fails, double-check your linked debit card or balance.

Maximizing Cash App Features with Support

Support isn’t just for troubleshooting—it can help you unlock perks like cash back through Boosts or troubleshoot Cash App Green (the metal debit card’s premium tier). For example, if a Boost isn’t applying at checkout, support can verify eligibility or suggest alternatives. Investors should note that Bitcoin investment queries may take longer to resolve due to market volatility, but the team can clarify fees or withdrawal limits. For digital finance newbies, Cash App’s support library includes guides on financial management, like setting up direct deposit for paychecks or tax refunds.

Handling Disputes and Fraud

If you spot unfamiliar charges, report them instantly via the app. Block, Inc. (Cash App’s parent company) emphasizes fraud protection, but users must act fast—delays can affect reimbursement eligibility. For disputes with merchants (e.g., undelivered goods), gather receipts and contact the seller first; if unresolved, Cash App Support may intervene. Remember: never share your login details, and be wary of scams promising free money—official support won’t ask for sensitive info via email or social media.

Pro Tips for Smooth Support Experiences

- Always check the app’s Status Page for outages before assuming an issue is account-specific.

- For Cash App Card replacements, note that expedited shipping may cost extra.

- Use clear subject lines in support requests (e.g., “Direct Deposit Not Received”) to speed up responses.

- If you’re switching from Square Inc. services (like Square Payroll), ensure your account details are updated to avoid financial flexibility hiccups.

By leveraging Cash App’s support resources wisely, you can navigate everything from everyday financial services snags to complex cryptocurrency inquiries—keeping your money secure and your experience seamless.

Professional illustration about Bitcoin

Cash App vs Venmo

Cash App vs Venmo: Which Peer-to-Peer Payment App Fits Your Digital Finance Needs?

When it comes to peer-to-peer payments, Cash App and Venmo are two of the biggest names in the game, but they cater to slightly different audiences. Both apps let you send money instantly, split bills, and even earn cash back, but their features diverge when you dig deeper.

Financial Flexibility and Unique Features

Cash App, owned by Block, Inc. (formerly Square Inc.), stands out with its Cash App Card, a customizable debit card linked to your balance. The card supports contactless payment and offers Boosts—instant discounts at select retailers. For those into Bitcoin investment, Cash App lets you buy, sell, and hold cryptocurrency directly, a feature Venmo only recently adopted. Cash App also integrates with Afterpay for buy-now-pay-later options and provides direct deposit capabilities, making it a strong choice for freelancers or gig workers.

Venmo, on the other hand, leans into social features, allowing users to share payment stories with emojis—great for splitting dinner with friends. While Venmo offers a debit card too, it lacks the Cash App Rewards program, which gives users perks like 10% off coffee or 15% cash back at grocery stores.

Security and Fraud Protection

Both apps prioritize financial security, but Cash App edges ahead with fraud monitoring powered by Sutton Bank and Wells Fargo Bank, N.A. Its Cash App Green feature (a secured credit builder card) helps users improve their credit scores, something Venmo doesn’t offer. Venmo does provide purchase protection for eligible transactions, but Cash App’s fraud protection is more robust, especially for ATM withdrawals and larger transfers.

Investment and Banking Services

If you’re into financial management beyond just payments, Cash App’s Cash App Investing LLC arm lets you trade stocks and Bitcoin with as little as $1. Venmo’s investment options are limited to crypto, and its interface is less intuitive for serious traders. Plus, Cash App’s direct deposit feature arrives up to two days early, a perk Venmo users miss out on.

The Bottom Line

Choose Cash App if you want financial flexibility, rewards, and investment tools—especially for bitcoin investment or free money through Boosts. Venmo is better for casual users who value social interactions and simple splits. Both are solid, but your pick depends on whether you prioritize digital finance features or social convenience.

Professional illustration about Boosts

Cash App vs PayPal

When comparing Cash App vs PayPal in 2025, both platforms dominate the peer-to-peer payments space, but they cater to slightly different audiences and offer unique features. Cash App, developed by Block, Inc. (formerly Square Inc.), is known for its simplicity, financial flexibility, and seamless integration with Bitcoin and Cash App Investing LLC. On the other hand, PayPal remains a heavyweight for global transactions, offering broader merchant acceptance and robust fraud protection.

Key Differences in Features:

- Peer-to-Peer Payments: Cash App excels with instant, fee-free transfers between users, while PayPal charges fees for instant transfers (though standard transfers are free).

- Debit Cards: The Cash Card (issued by Sutton Bank) and Cash App Green (a premium tier) offer Boosts for discounts at select retailers, while PayPal’s debit card provides cash back rewards.

- Cryptocurrency: Cash App allows users to buy, sell, and hold Bitcoin with ease, whereas PayPal supports multiple cryptocurrencies but restricts transfers to external wallets.

- Direct Deposit: Both platforms support direct deposit, but Cash App offers early access to paychecks (up to two days sooner) for eligible users.

Financial Management & Security:

Cash App leans into digital finance for younger users, with features like ATM withdrawals (fee-free at in-network ATMs) and contactless payment via the Cash Card. PayPal, however, appeals to businesses and freelancers with invoicing tools and stronger fraud monitoring. For financial security, PayPal’s purchase protection is more comprehensive, while Cash App relies on fraud protection alerts and optional PIN/face ID locks.

Investing & Rewards:

With Cash App Investing LLC, users can trade stocks and Bitcoin commission-free, making it a hybrid financial services platform. PayPal lacks investing options but compensates with broader cash back programs. Meanwhile, Cash App Rewards (via Boosts) provide instant discounts at partners like Starbucks or Uber, whereas PayPal’s rewards are more traditional (e.g., points for purchases).

The Verdict:

Choose Cash App if you prioritize Bitcoin investment, quick P2P payments, and lifestyle perks like Boosts. Opt for PayPal if you need global reach, business tools, or enhanced buyer protection. Both integrate with Afterpay for installment payments, but Cash App’s partnership with Wells Fargo Bank, N.A. ensures smoother banking linkages for U.S. users. Ultimately, your choice depends on whether you value free money perks (Cash App) or a battle-tested financial management ecosystem (PayPal).

Professional illustration about Cryptocurrency

Cash App Promotions

Cash App Promotions

Cash App regularly rolls out limited-time promotions to reward users, boost engagement, and attract new customers. In 2025, Block, Inc. (formerly Square, Inc.) has continued innovating with Cash App Rewards, Boosts, and referral incentives, making it one of the most competitive digital finance platforms. Promotions often target key features like the Cash App Card, Cash App Investing LLC, or Bitcoin transactions, giving users opportunities to earn cash back, free stock, or even free money through sign-up bonuses.

One of the most popular promotions is Cash App Boosts, which provides instant discounts at select merchants when using the Cash Card (issued by Sutton Bank or Wells Fargo Bank, N.A.). For example, a recent Boost offered 10% cash back at coffee shops, while another provided $5 off grocery purchases—ideal for users seeking financial flexibility. These Boosts are location-based and rotate frequently, so checking the app weekly ensures you don’t miss out. Additionally, Afterpay integration now allows Cash App users to split purchases into installments while still qualifying for Boosts.

Referral programs remain a staple of Cash App promotions. In 2025, inviting friends to sign up and send at least $5 can earn both parties up to $15—a win-win for peer-to-peer payments enthusiasts. For those interested in cryptocurrency, Cash App occasionally waives Bitcoin purchase fees or offers bonus Bitcoin for first-time buyers. Security is never compromised, as all transactions include fraud monitoring and fraud protection, ensuring financial security while capitalizing on promotions.

Direct deposit users also benefit from exclusive perks. Setting up payroll or government deposits (like tax refunds) can unlock early paycheck access or one-time cash bonuses. For example, a recent promotion awarded $50 for maintaining a direct deposit of $300+ for two consecutive months—perfect for improving financial management. Meanwhile, ATM withdrawals remain fee-free (up to a limit) for direct deposit users, adding another layer of value.

To maximize promotions, enable notifications in the app and follow Cash App’s official social channels for real-time updates. Whether you’re leveraging contactless payment rewards, exploring bitcoin investment deals, or stacking Boosts with everyday purchases, staying proactive ensures you get the most out of Cash App’s ever-evolving incentives.

Professional illustration about Deposit

Cash App for Business

Cash App for Business is revolutionizing how small businesses and freelancers handle finances, offering a seamless blend of peer-to-peer payments, direct deposit, and financial management tools. With features like the Cash App Card, businesses can make contactless payments, withdraw cash at ATMs, and even earn cash back with Boosts—discounts tailored for everyday expenses. The integration with Block, Inc. (formerly Square) ensures robust fraud protection and financial security, making it a trusted choice for entrepreneurs. For businesses dealing in cryptocurrency, Cash App provides a straightforward platform to buy, sell, or hold Bitcoin, adding flexibility for modern financial strategies.

One standout feature is Cash App Investing LLC, which allows businesses to diversify their funds effortlessly. Whether it’s stashing surplus cash or exploring bitcoin investment, the app simplifies the process without requiring a brokerage account. Businesses can also leverage Cash App Rewards to incentivize customer loyalty, offering perks like instant discounts or free money promotions. Partnering with Sutton Bank and Wells Fargo Bank, N.A., Cash App ensures reliable banking services, including ATM withdrawals and fraud monitoring, so businesses can operate with confidence.

For businesses using Afterpay, Cash App’s compatibility with buy-now-pay-later services adds another layer of financial flexibility. The app’s digital finance tools, like customizable invoices and instant payment alerts, streamline operations, while the debit card functionality eliminates the need for traditional business banking hurdles. With Cash App Green, businesses can even offset their carbon footprint, appealing to eco-conscious clients. From freelancers to retail shops, Cash App for Business is more than just a payment app—it’s a full-scale financial services hub designed for growth and efficiency.