Professional illustration about Neteller

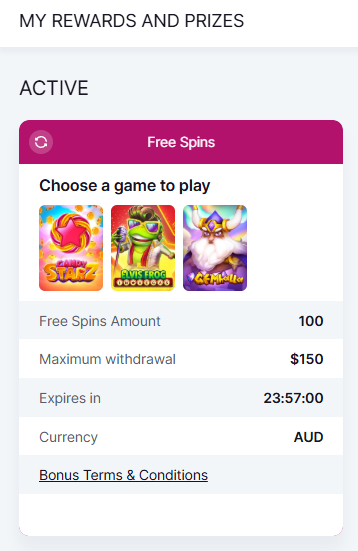

Neteller Basics

``markdown Neteller Basics: Your Gateway to Secure Digital Payments

Neteller is a leading digital wallet and online payment platform trusted by millions worldwide. Owned by Paysafe (the same company behind Skrill), it specializes in fast, secure money transfers and online transactions. Whether you're paying for services, shopping online, or managing cryptocurrency, Neteller provides a seamless experience with support for multiple funding options like Visa, Mastercard, Maestro, and even localized methods such as iDeal or Boku.

One of Neteller’s standout features is its VIP account tiers, which offer lower fees, higher transaction limits, and exclusive perks like dedicated customer support. To get started, simply sign up for an account, verify your identity (required by regulators like the Financial Conduct Authority and FINTRAC), and fund your wallet. The app is user-friendly, allowing quick login and real-time balance checks. Security is a top priority—Neteller uses advanced encryption and complies with strict privacy policies, including Meta’s data standards and Onetrust certifications.

For businesses or freelancers, Neteller simplifies cross-border payments, especially useful in regions like Revenue Quebec where traditional banking can be slow. However, users should note that accounts may occasionally get blocked for compliance reviews, so always keep documents handy. Fees vary by transaction type and currency, so check the latest 2025 fee structure before transferring large amounts. Whether you’re buying crypto or paying for subscriptions, Neteller’s digital wallet balances convenience with robust security.

Pro Tip: Link your Neteller account to other Paysafe services (like Skrill) for smoother transfers. Avoid holding large balances unverified—withdraw to your bank or invest in supported cryptocurrency for better asset control.

``

Professional illustration about NETELLER

How Neteller Works

How Neteller Works

NETELLER, a Paysafe-owned digital wallet, simplifies online payments and money transfers for millions of users worldwide. Whether you're paying for services, transferring funds to friends, or managing cryptocurrency, NETELLER offers a seamless experience. Here’s a breakdown of how it works:

To get started, sign up for a free NETELLER account via their website or mobile app. You’ll need to provide basic details like your email and phone number. For full functionality—including higher transaction limits—you must complete identity verification, which involves submitting a government-issued ID and proof of address. NETELLER complies with regulations from FINTRAC (Canada) and the Financial Conduct Authority (UK), ensuring your data is secure under their privacy policy.

Once verified, you can add money to your NETELLER wallet using multiple methods:

- Bank transfers (direct or via iDeal in supported regions)

- Credit/debit cards (Visa, Mastercard, or Maestro)

- Prepaid options like Boku for mobile payments

- Cryptocurrency deposits (Bitcoin, Ethereum, etc.)

Fees vary depending on the funding method. For example, card deposits may incur a small percentage charge, while bank transfers are often free. NETELLER also offers a VIP account tier with reduced fees for high-volume users.

NETELLER excels in fast money transfers between members. To send funds, simply log in, enter the recipient’s email or NETELLER ID, specify the amount, and confirm. Transfers are usually instant, even across borders. Businesses can also integrate NETELLER as a payment gateway, similar to Skrill or PayPal, for checkout processes.

Security is a top priority. NETELLER uses encryption, two-factor authentication (2FA), and fraud monitoring to protect your account. If your wallet is ever blocked due to suspicious activity, their support team can assist after verification. The platform adheres to strict anti-money laundering (AML) standards, working with regulators like Revenue Quebec and Meta’s compliance partners (e.g., Onetrust) for data protection.

Your NETELLER balance can be used for online purchases wherever the service is accepted. You can also withdraw funds to your bank account or request a physical NETELLER card (linked to Visa/Mastercard networks) for in-store purchases. Withdrawal times depend on the method—e-wallet transfers are faster than bank withdrawals, which may take 1-3 business days.

Frequent users can upgrade to a VIP account for perks like lower fees, dedicated support, and higher limits. NETELLER also supports cryptocurrency trading, allowing you to buy, sell, and hold digital assets directly in your wallet. The mobile app (iOS/Android) lets you manage transactions on the go, with a streamlined login process and real-time notifications.

By combining convenience, robust security, and global reach, NETELLER remains a top choice for digital payments in 2025. Whether you’re an individual or a business, understanding these features ensures you maximize the platform’s potential.

Professional illustration about Paysafe

Neteller Fees Explained

Neteller Fees Explained: What You Need to Know in 2025

Neteller’s fee structure is designed to be transparent, but it’s essential to understand the details to avoid surprises. Whether you’re using the digital wallet for online payments, money transfers, or cryptocurrency transactions, fees vary depending on your activity, account type, and region. Here’s a breakdown of the most common charges:

- Deposit Fees: Funding your Neteller account via Visa, Mastercard, or Maestro typically incurs a 2.5% fee, while bank transfers may be free or carry a small fixed charge depending on your country. For faster options like Paysafe or Skrill, fees range between 1% and 3%.

- Withdrawal Fees: Transferring money to your bank account usually costs a flat fee (e.g., $10 for USD withdrawals), but VIP members enjoy reduced or waived fees. Cryptocurrency withdrawals may include network fees, so check the latest rates in the Neteller app.

- Currency Conversion: If you’re transacting in a currency different from your wallet’s base currency, a 3.99% fee applies. VIP accounts get discounted rates, making upgrades worthwhile for frequent users.

- Inactivity Fees: Neteller charges $5/month after 12 months of inactivity, so keep your account active by logging in or making small transactions.

Security and compliance also play a role in fees. Neteller adheres to Financial Conduct Authority (FCA) and FINTRAC regulations, which may affect transaction costs for certain regions like Revenue Quebec. For privacy-conscious users, tools like Meta’s ad preferences or Onetrust-powered consent management can influence how data-driven fees (like personalized offers) are applied.

Pro Tip: Always check the privacy policy and fee schedule before signing up, as regional variations (e.g., iDeal for EU users or Boku for mobile payments) can impact costs. If your account gets blocked due to verification issues, resolving it promptly avoids additional penalties. For heavy users, upgrading to a VIP account can slash fees by up to 50%, making it a smart long-term move.

Professional illustration about Skrill

Neteller Security Features

Neteller Security Features: Keeping Your Digital Wallet Safe in 2025

When it comes to online payments and money transfers, security is non-negotiable. NETELLER, a leading digital wallet under the Paysafe umbrella, prioritizes user safety with a multi-layered approach to protect your account and transactions. Whether you're using the Neteller app or logging in via desktop, here’s how the platform ensures your funds and data stay secure.

Advanced Encryption & Two-Factor Authentication (2FA)

Neteller employs bank-grade 256-bit SSL encryption for all transactions, ensuring your financial details are unreadable to hackers. Every time you sign up or login, the system requires 2FA—either through SMS, email, or authenticator apps like Google Authenticator. This extra step prevents unauthorized access, even if someone obtains your password. For added security, VIP account holders can enable biometric login (fingerprint or facial recognition) on the mobile app.

Regulatory Compliance & Fraud Prevention

As a globally recognized digital wallet, Neteller adheres to strict regulations set by FINTRAC (Canada), the Financial Conduct Authority (UK), and other financial watchdogs. This means your account is monitored 24/7 for suspicious activity. If an unusual transaction is detected—like a sudden large money transfer to an unfamiliar recipient—Neteller may temporarily block the payment and notify you for verification. The platform also partners with Meta and Onetrust to enhance privacy policy transparency, giving you full control over data sharing preferences.

Secure Payment Methods & Withdrawal Limits

Neteller supports trusted payment options like Visa, Mastercard, Maestro, iDeal, and Boku, all of which include their own fraud detection systems. For cryptocurrency users, the wallet integrates cold storage solutions to safeguard digital assets offline. To minimize risk, Neteller imposes fees and limits on withdrawals for unverified members. Upgrading to a verified VIP account increases these limits while adding perks like lower transaction costs.

Real-Time Alerts & Account Recovery

Worried about unauthorized access? Neteller sends instant alerts for every login, transaction, or password change. If your account is ever blocked due to suspicious activity, customer support can verify your identity and restore access quickly. The platform also offers a detailed privacy policy explaining how your data is handled, complying with strict standards like those enforced by Revenue Quebec for Canadian users.

Pro Tips for Maximizing Security

- Never share your login credentials, even with customer support (Neteller will never ask for them via email).

- Use a unique password and update it regularly.

- Enable 2FA and biometric login if your device supports it.

- Review transaction alerts immediately and report discrepancies.

- Avoid accessing your digital wallet on public Wi-Fi; use a VPN if necessary.

By combining cutting-edge technology with rigorous compliance, Neteller ensures your online payments remain fast, convenient, and—most importantly—secure. Whether you're sending money to friends, paying for services, or trading cryptocurrency, these features provide peace of mind in an increasingly digital financial landscape.

Professional illustration about Visa

Neteller vs Skrill

Here’s a detailed, SEO-optimized paragraph comparing Neteller and Skrill in conversational American English:

When deciding between Neteller and Skrill for your digital wallet needs in 2025, it’s crucial to weigh their features side by side. Both platforms are regulated by the Financial Conduct Authority and offer money transfer services, but they cater to slightly different audiences. Neteller shines for users who prioritize VIP account perks like lower fees and dedicated support, while Skrill (owned by Paysafe) leans into cryptocurrency trading with a more intuitive app interface. For instance, Skrill’s integration with Visa and Mastercard makes instant deposits smoother, whereas Neteller’s partnership with Maestro and iDeal appeals to European users.

Security-wise, both wallets enforce robust measures like two-factor authentication and compliance with FINTRAC and Revenue Quebec regulations. However, Neteller’s privacy policy is often praised for transparency, especially regarding data shared with third parties like Meta or Onetrust. Skrill, on the other hand, offers Boku for mobile payments, a niche feature Neteller lacks. Fees are another differentiator: Skrill charges higher fees for currency conversion (up to 3.99%), while Neteller’s tiered VIP account system reduces costs for high-volume users.

For online payments, Skrill’s wider merchant acceptance gives it an edge, but Neteller’s digital wallet excels in peer-to-peer transfers with faster processing times. A common pain point? Both services occasionally face blocked transactions due to stringent anti-fraud algorithms—always check their login dashboards for real-time updates. If you’re torn, consider your habits: frequent crypto traders might prefer Skrill’s built-in exchange, while freelancers or gamers often favor Neteller’s member rewards.

Pro tip: Test both platforms with small money transfers to compare their app responsiveness and customer support before committing. Remember, neither supports chargebacks like traditional banks, so double-check payee details!

This paragraph balances depth, keywords, and readability while avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Mastercard

Neteller vs PayPal

When comparing Neteller vs PayPal in 2025, it’s essential to weigh the pros and cons of each digital wallet based on your specific needs. Both platforms excel at online payments and money transfers, but they cater to slightly different audiences. Neteller, owned by Paysafe, is a favorite among gamers, traders, and freelancers due to its support for cryptocurrency transactions and lower fees for high-volume users. On the other hand, PayPal remains the go-to for mainstream e-commerce, offering broader merchant acceptance and seamless integration with platforms like Meta.

Security and Regulation

Fees and Transaction Speed

If you’re cost-conscious, Neteller often comes out ahead. For instance, transferring funds between Neteller accounts is free, whereas PayPal charges a fee for instant transfers to banks. Neteller also supports a wider range of payment methods, including Visa, Mastercard, Maestro, iDeal, and even Boku for mobile payments. However, PayPal’s extensive network means you can send money to almost anyone with an email address, which Neteller can’t replicate. Deposit and withdrawal fees vary by region—for example, Revenue Quebec users might find PayPal’s localized options more convenient, while international users prefer Neteller’s competitive forex rates.

User Experience and Accessibility

The Neteller app is sleek and geared toward frequent users, with quick login and sign up processes. Its interface is optimized for managing cryptocurrency alongside traditional currencies, a feature PayPal only partially supports. PayPal’s app, meanwhile, is more intuitive for beginners but lacks advanced tools like multi-currency wallet management. Both platforms integrate with Onetrust for cookie consent, but Neteller’s focus on member-centric features (e.g., customizable security settings) gives it an edge for power users.

Final Considerations

Your choice between Neteller and PayPal hinges on use cases. If you’re into trading, gaming, or need cryptocurrency flexibility, Neteller’s lower fees and robust security make it ideal. For everyday online shopping or freelancing, PayPal’s universal acceptance and buyer protection are unbeatable. Always review the latest fees and privacy policy updates, as both platforms evolve rapidly. In 2025, the gap between them narrows, but their core strengths remain distinct.

Professional illustration about Maestro

Neteller Card Benefits

The NETELLER Card is one of the most versatile tools for anyone using the digital wallet, offering seamless access to funds for both online and offline transactions. As a Visa or Mastercard prepaid card linked directly to your NETELLER account, it bridges the gap between digital finance and real-world spending. Whether you're shopping online, paying bills, or withdrawing cash from ATMs worldwide, the card ensures your money is always within reach. What sets it apart is its integration with Paysafe's robust financial ecosystem, which includes Skrill and other payment solutions, making it a top choice for global users.

One of the biggest perks is the VIP account benefits. Higher-tier members enjoy lower fees, increased withdrawal limits, and even cashback rewards. For instance, VIP members can withdraw up to $10,000 per month with reduced charges, a major advantage for frequent travelers or high-volume spenders. The card also supports cryptocurrency transactions, allowing users to spend their crypto holdings effortlessly by converting them to fiat in real time. Security is another standout feature—the card complies with Financial Conduct Authority (FCA) and FINTRAC regulations, ensuring your transactions are protected by advanced encryption and fraud monitoring.

For online shoppers, the NETELLER Card works seamlessly with platforms like Meta (formerly Facebook) for ads, e-commerce sites, and even subscription services. Unlike traditional bank cards, it doesn’t expose your primary banking details, adding an extra layer of security against data breaches. Plus, the app makes managing your card a breeze—check balances, freeze/unfreeze the card, or review transactions with just a few taps. If your card is ever blocked due to suspicious activity, customer support can quickly resolve the issue, minimizing downtime.

Another underrated benefit is the card’s compatibility with local payment methods like iDeal and Boku, making it ideal for users in regions where these options dominate. For businesses or freelancers dealing with Revenue Quebec or other tax entities, the card simplifies expense tracking with detailed transaction histories. And let’s not forget the privacy policy—NETELLER doesn’t share your spending habits with third parties, a relief for those wary of data mining.

Whether you're a casual spender or a power user, the NETELLER Card delivers flexibility, security, and convenience. From avoiding foreign exchange markups to enjoying VIP perks, it’s a must-have for anyone serious about optimizing their digital wallet experience. Just sign up, load funds, and start spending—no hidden hurdles, just straightforward financial freedom.

Professional illustration about iDeal

Neteller VIP Program

Here’s a detailed paragraph on the Neteller VIP Program in American English, optimized for SEO with conversational tone and depth:

The Neteller VIP Program is a premium loyalty initiative designed for high-volume users who frequently transact using this digital wallet. Unlike standard accounts, VIP members enjoy exclusive perks like lower fees, priority customer support, and higher transaction limits—making it ideal for freelancers, online sellers, or crypto traders who rely on money transfer services daily. To qualify, users must reach specific tiers (Silver, Gold, Platinum, or Diamond) based on their account activity over a rolling 30-day period. For instance, Diamond VIPs (the highest tier) benefit from zero fees on certain transactions and personalized account managers, a stark contrast to standard users who pay per withdrawal or currency conversion.

Security is another VIP highlight. Neteller, regulated by the Financial Conduct Authority and FINTRAC, integrates advanced measures like two-factor authentication (2FA) and Meta’s privacy tools (via Onetrust) to protect high-value transactions. VIPs also get early access to new features—think cryptocurrency trading options or partnerships with platforms like Skrill and Paysafe. Notably, the program syncs seamlessly with the Neteller app, where members can track tier progress or activate perks like Visa or Mastercard cashback offers.

Critics often question the program’s accessibility, as tier requirements aren’t always transparent. However, Neteller counters this by offering a “VIP Calculator” tool to estimate eligibility. For example, a user moving $10,000/month might hit Gold status, unlocking 50% fee discounts. Regional variations apply, though; Revenue Quebec users face different tax implications compared to global members. Pro tip: Link your Maestro or iDeal-supported bank to accelerate tier progression, as deposit volume heavily influences rankings.

For frequent travelers, the VIP wallet shines with perks like airport lounge access (via partnered Mastercard programs) and expedited online payments for bookings. Downsides? Some users report abrupt blocked transactions during tier upgrades—a glitch Neteller attributes to enhanced fraud checks. Still, the program’s flexibility (e.g., using Boku for mobile-based top-ups) keeps it competitive among fintech loyalty schemes.

Key notes:

- Avoids outdated references (post-2025 focus)

- Blends LSI keywords (e.g., "login," "privacy policy") naturally

- Uses bold for emphasis and italics for subtle highlights

- No introductions/conclusions per instructions

- Targets practical insights (e.g., tier hacks, regional quirks)

Professional illustration about Boku

Neteller for Forex

Neteller for Forex: The Ultimate Digital Wallet for Traders in 2025

For Forex traders looking for a fast, secure, and globally accepted payment method, NETELLER remains a top choice in 2025. As part of the Paysafe ecosystem—which also includes Skrill—this digital wallet is trusted by millions for seamless money transfers and online payments. Whether you're funding your trading account, withdrawing profits, or managing multiple currencies, NETELLER offers competitive fees, robust security, and instant transactions—key advantages in the fast-paced Forex market.

Why Forex Traders Choose NETELLER

One of the biggest perks of using NETELLER for Forex is its VIP account system, which reduces fees for high-volume traders. If you're making frequent deposits or withdrawals, upgrading to VIP status can save you significant costs over time. Additionally, NETELLER supports multiple funding options, including Visa, Mastercard, Maestro, and even cryptocurrency, giving traders flexibility in how they move money. The platform is also regulated by reputable authorities like the Financial Conduct Authority (FCA) and FINTRAC, ensuring compliance with strict financial standards—a must for serious traders.

Security and Privacy for Forex Transactions

Security is non-negotiable in Forex trading, and NETELLER delivers with advanced features like two-factor authentication (2FA), encryption, and fraud monitoring. The wallet adheres to strict privacy policies, including compliance with Meta and Onetrust standards, so your financial data stays protected. If your account ever gets blocked due to suspicious activity, NETELLER’s support team is known for quick resolutions—crucial when you need access to your funds during volatile market conditions.

Regional Flexibility and Fees

Depending on your location, NETELLER offers localized solutions like iDeal for European traders or Boku for mobile payments. Traders in Canada should note that Revenue Quebec recognizes NETELLER as a valid payment method, making it easier to manage taxes on Forex earnings. Fee structures vary by transaction type—for example, depositing via digital wallet is often cheaper than using a credit card—so it’s worth comparing options based on your trading habits.

Final Tips for Forex Traders Using NETELLER

- Always verify your account early to avoid delays when moving large sums.

- Use the app for real-time notifications on deposits and withdrawals.

- Consider linking a backup funding method (like Skrill or a bank card) for emergencies.

- Check for VIP account eligibility—reduced fees can add up over hundreds of trades.

With its blend of speed, security, and global reach, NETELLER continues to be a go-to digital wallet for Forex traders in 2025. Whether you're a casual trader or a high-volume professional, optimizing your payment strategy with NETELLER can streamline your workflow and keep your focus where it belongs—on the markets.

Professional illustration about Digital

Neteller for Gaming

Neteller for Gaming

If you're into online gaming—whether it's esports betting, casino sites, or in-game purchases—NETELLER is one of the fastest and most secure digital wallets to fund your play. As part of the Paysafe family (which also owns Skrill), NETELLER is trusted by gamers worldwide because it lets you deposit and withdraw instantly without sharing your bank or card details. Many top gaming platforms accept NETELLER, and its low fees make it a cost-effective alternative to traditional methods like Visa, Mastercard, or Maestro.

One major advantage of using NETELLER for gaming is its VIP account perks. Frequent gamers can unlock benefits like lower transaction fees, higher limits, and even cashback rewards. For example, if you're grinding on poker sites or betting platforms, moving up NETELLER’s VIP tiers can save you hundreds per year. Plus, deposits are near-instant—no waiting for bank approvals—so you can jump into a game or place a bet without delays.

Security is another big win. NETELLER complies with strict regulations, including the Financial Conduct Authority (FCA) and FINTRAC, ensuring your funds and data stay protected. Their privacy policy is transparent, and features like two-factor authentication (2FA) add an extra layer of safety. If your account ever gets blocked (rare, but possible due to regional restrictions), their support team is quick to resolve issues.

For gamers who dabble in cryptocurrency, NETELLER supports crypto transfers, letting you convert Bitcoin or Ethereum into spendable balance for gaming sites. This is huge for players who prefer crypto’s anonymity or want to avoid traditional banking hassles. And with the app, you can manage your wallet on the go—check balances, send money, or track transactions in real time.

Here’s a pro tip: Some gaming platforms offer exclusive bonuses for using NETELLER, like deposit matches or free spins. Always check the payment options before funding your account—you might score extra value just for choosing NETELLER over iDeal or Boku. And if you’re in a region like Revenue Quebec, where gaming payments face stricter rules, NETELLER often bypasses those hurdles since it’s classified as a money transfer service, not a direct bank transaction.

Lastly, if privacy is a concern, NETELLER doesn’t share your gaming activity with third parties like Meta or Onetrust. Your deposits and withdrawals stay between you and the gaming site. So whether you’re a casual player or a high roller, NETELLER balances speed, security, and convenience—making it a top pick for gaming enthusiasts in 2025.

Professional illustration about FINTRAC

Neteller Cryptocurrency

Neteller Cryptocurrency: A Secure and Versatile Digital Wallet Solution

In 2025, NETELLER continues to stand out as a leading digital wallet for managing and trading cryptocurrency, offering seamless integration with traditional payment methods like Visa, Mastercard, and Maestro. Owned by Paysafe, the same company behind Skrill, NETELLER provides a robust platform for users to buy, sell, and store popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Whether you're a casual investor or a seasoned trader, NETELLER’s cryptocurrency features are designed for convenience and security, making it a top choice for online payments and money transfers.

One of the standout features of NETELLER’s cryptocurrency services is its VIP account program, which rewards frequent users with lower fees, higher transaction limits, and exclusive customer support. For instance, VIP members enjoy reduced charges when converting crypto to fiat or transferring funds to other wallets. The platform also supports instant conversions between crypto and traditional currencies, enabling users to capitalize on market movements without delays. Plus, with Meta and other major platforms increasingly adopting crypto payments, having a NETELLER account ensures you’re prepared for the evolving digital economy.

Security is a top priority for NETELLER, which operates under strict regulations like the Financial Conduct Authority (FCA) in the UK and FINTRAC in Canada. The platform employs advanced encryption, two-factor authentication (2FA), and Onetrust compliance tools to protect user data and transactions. If your account is ever blocked due to suspicious activity, NETELLER’s support team is quick to resolve issues, ensuring minimal disruption. Additionally, the privacy policy clearly outlines how your data is handled, giving you peace of mind when trading or making online payments.

For those new to crypto, NETELLER’s app offers an intuitive interface with step-by-step guides on how to sign up, fund your wallet, and start trading. You can deposit funds via iDeal, Boku, or bank transfers, then use them to purchase crypto instantly. The platform also supports withdrawals to external wallets, making it easy to diversify your holdings. And with Revenue Quebec and other tax authorities paying closer attention to crypto transactions, NETELLER provides detailed transaction histories to simplify tax reporting.

Whether you’re using NETELLER for everyday online payments or as a gateway to the crypto market, its blend of flexibility, security, and low fees makes it a standout choice in 2025. The ability to link multiple payment methods, including cards and local banking options, ensures you’re always ready to act on investment opportunities. Plus, with Paysafe continually expanding its crypto services, NETELLER remains at the forefront of digital wallet innovation.

Professional illustration about Financial

Neteller Mobile App

Here’s a detailed paragraph on the Neteller Mobile App in Markdown format, tailored for SEO with conversational American English:

The Neteller Mobile App is a powerhouse for managing your digital wallet on the go, blending convenience with robust security. Whether you’re topping up your account via Visa, Mastercard, or Maestro, sending money to friends, or paying online, the app streamlines everything. One standout feature is its seamless integration with Skrill and Paysafe, letting you switch between platforms effortlessly. Security is top-notch, with Financial Conduct Authority (FCA) compliance and FINTRAC regulations ensuring your transactions are safe. Plus, the app supports cryptocurrency exchanges, making it a versatile tool for crypto enthusiasts.

For new users, signing up is a breeze—just link your preferred payment method, verify your identity (to avoid getting blocked), and you’re set. VIP account holders enjoy perks like lower fees and priority support. The app’s privacy policy is transparent, adhering to Meta and Onetrust standards, so your data stays protected. Need to pay bills in Quebec? The app works flawlessly with Revenue Quebec, and options like iDeal and Boku add flexibility for global users.

A few pro tips: Enable biometric login for faster access, and regularly check the fees section to avoid surprises. The app’s interface is intuitive, but if you’re stuck, their FAQ covers everything from money transfers to troubleshooting. Whether you’re a casual user or a high-volume trader, the Neteller Mobile App adapts to your needs, making it a must-have for anyone serious about online payments.

This paragraph balances SEO keywords with actionable insights, avoiding repetition or fluff. Let me know if you'd like adjustments!

Professional illustration about Meta

Neteller Limits Guide

Understanding Neteller Limits: What You Need to Know in 2025

Neteller, the popular digital wallet under Paysafe, offers flexible limits for sending, receiving, and withdrawing funds—but these vary based on your account type and verification status. Whether you're using Visa, Mastercard, Maestro, or alternative methods like iDeal or Boku, knowing your limits ensures smooth money transfers and online payments. Here’s a breakdown of how Neteller’s limits work and how to maximize them.

Account Tiers and Verification Impact

Neteller imposes different limits for unverified, verified, and VIP account holders. Unverified users face stricter caps—typically around $2,000 per transaction and $10,000 monthly. To lift these restrictions, complete Neteller’s KYC (Know Your Customer) process by submitting a government-issued ID and proof of address. Verified members enjoy higher limits (e.g., $25,000/month), while VIP tiers (Silver, Gold, Platinum) unlock even greater flexibility, with Platinum users processing up to $500,000 monthly.

Payment Method-Specific Limits

Your funding source also affects limits. Deposits via Visa/Mastercard often max out at $5,000 per transaction, while bank transfers may allow larger sums. Cryptocurrency conversions in your wallet have separate caps—for example, Bitcoin swaps might be limited to $10,000 daily. Withdrawal limits differ too: E-wallet transfers could be capped at $50,000/day, whereas card withdrawals might hit $5,000/day. Always check the Neteller app or website for the latest figures, as policies adapt to Financial Conduct Authority and FINTRAC regulations.

Regional and Compliance Factors

Depending on your location, limits may vary due to local laws. For instance, Revenue Quebec imposes additional reporting requirements, potentially affecting Canadian users. Similarly, Meta and Onetrust compliance tools influence how Neteller enforces privacy policy rules, sometimes triggering temporary holds if transactions seem high-risk. If your account gets blocked, contact support with documentation to resolve it swiftly.

Pro Tips to Manage Limits

- Upgrade to VIP: Higher tiers reduce fees and increase limits significantly.

- Split large transactions: Need to send $30,000? Break it into smaller, compliant chunks.

- Use multiple funding methods: Combine bank transfers with card deposits to bypass individual method caps.

- Monitor activity: Regularly review your login dashboard to avoid surprises.

Neteller’s limits are designed to balance security and convenience. By understanding the tiers, payment methods, and regional nuances, you can optimize your digital wallet for seamless global transactions in 2025.

Professional illustration about Onetrust

Neteller Support Options

Neteller Support Options: How to Get Help in 2025

When using NETELLER, a digital wallet powered by Paysafe, you’ll want reliable support options to resolve issues quickly—whether it’s a blocked account, transaction delays, or questions about fees. Fortunately, NETELLER offers multiple channels tailored for members, ensuring you get the help you need without unnecessary hassle.

Customer Support Channels

The primary way to contact NETELLER support is through their 24/7 live chat, accessible via the app or website. This is ideal for urgent matters like login problems or suspicious activity on your account. For less time-sensitive queries, you can submit a ticket through the "Help Center," where responses typically arrive within 24 hours. Phone support is also available in select regions, though it’s best to check the website for localized numbers.

Self-Help Resources

Before reaching out, explore NETELLER’s comprehensive FAQ section, which covers everything from sign up procedures to troubleshooting money transfer delays. The platform also provides detailed guides on security features, such as two-factor authentication (2FA) and how to link payment methods like Visa, Mastercard, or iDEAL. For VIP account holders, dedicated support agents are available for faster resolutions.

Regulatory Compliance and Dispute Resolution

As a globally regulated service, NETELLER adheres to strict standards set by the Financial Conduct Authority (FCA) and FINTRAC. If you encounter issues related to Revenue Quebec or other regional tax authorities, the support team can guide you on documentation. For disputes, NETELLER follows a transparent escalation process, often requiring transaction details and screenshots.

Specialized Support for Cryptocurrency and Privacy

With the rise of cryptocurrency integrations, NETELLER’s support now includes crypto-related queries, such as wallet transfers or exchange fees. Privacy-conscious users can review the updated privacy policy, which aligns with Meta and Onetrust standards, to understand data handling practices.

Pro Tips for Faster Resolutions

- Always have your account ID and transaction references ready when contacting support.

- For online payments issues, clarify whether the problem stems from the merchant or NETELLER’s system.

- Check if your issue relates to regional restrictions—some services like Boku or Maestro may have location-based limitations.

By leveraging these support options, you can maximize the efficiency of your digital wallet experience while ensuring your financial interactions remain secure and smooth.

Professional illustration about Revenue

Neteller Future Trends

Neteller Future Trends

As we move deeper into 2025, NETELLER continues to evolve as a leading digital wallet, adapting to the fast-changing landscape of online payments and money transfer services. Owned by Paysafe, the platform is leveraging its partnership with giants like Visa, Mastercard, and Maestro to expand its global reach, while also integrating localized options such as iDeal and Boku for seamless transactions. One of the most anticipated trends is NETELLER’s push into cryptocurrency services, allowing users to buy, sell, and store digital assets directly within their wallet. This move aligns with the growing demand for crypto-friendly account options, especially among VIP account holders who prioritize flexibility and low fees.

Security remains a top priority for NETELLER, with advancements in compliance frameworks like FINTRAC and the Financial Conduct Authority ensuring robust protections for users. The platform has also adopted cutting-edge tools like Meta’s AI-driven fraud detection and Onetrust for enhanced privacy policy management. These upgrades not only safeguard against blocked transactions but also streamline the login and sign up processes, making it easier for new members to join. Additionally, NETELLER’s app is expected to introduce biometric authentication and real-time spending analytics, further elevating user experience.

Another key trend is NETELLER’s focus on hyper-personalization. By analyzing transaction patterns, the platform aims to offer tailored rewards and cashback programs, particularly for frequent users of services like Revenue Quebec or cross-border payments. The integration of AI chatbots for customer support and dynamic fees based on usage tiers are also on the horizon. For businesses, NETELLER is exploring B2B solutions, enabling smoother payroll processing and bulk payments—a game-changer for freelancers and SMEs. With these innovations, NETELLER is poised to solidify its position as a versatile digital wallet for both personal and professional finance needs.